is the interest i paid on my car loan tax deductible

She borrowed money to buy the vehicle and the interest she paid in her 2021 fiscal period was 2200. The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation.

Is Car Loan Interest Tax Deductible In The Uk

As for your loan the good news continues.

. If the vehicle is entirely for personal use. Personal credit card interest auto loan interest. If on the other hand the car is used entirely for business purposes the full amount of interest may be waived.

The standard mileage rate already factors in costs like gas taxes and insurance. Not all interest is tax-deductible including that which is associated with credit cards and auto loans. When claiming deductions of any kind on your tax returns it is best to keep detailed records and.

Only vehicles driven for business purposes do which is why your new tow truck would be eligible. To the right of the Vehicle expenses click Edit. You cannot deduct the actual car operating costs if you choose the standard mileage rate.

Answered on Dec 03 2021. Reporting the interest from these loans as a tax deduction is fairly straightforward. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan.

You can with some limits deduct the interest you pay on debts. A business loan is not taxable income because you are legally obligated to pay it back. But if you own your business or youre self-employed its a different story.

Loan paid car deductible tax interest Fhaloansapplication Tax Deduction for Interest paid on Car Loan Thus as the interest on car loan is allowed to be treated as an expense this reduces the income tax liability of the person availing the loan. But there is one exception to this rule. You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain conditions.

Answered on Dec 02 2021. This is because you can only deduct car loans interest for your business. Of course all vehicles do not qualify.

This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction. If on the other hand the car is used entirely for business purposes the full amount of. You cant even deduct depreciation from your business car because thats also factored in.

Your modified adjusted gross income is below 70000. Under Your income click on EditAdd to the right of Self-employment income. No personal driving will be included in these deductions.

Only the interest is tax-deductible. In most cases each payment consists of two components. If you use your car for business purposes you may be able to deduct actual vehicle expenses.

The personal portion of the interest will not be deductible. If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay 12. In this case neither the business portion nor the personal portion of the interest will be deductible.

This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction. Common deductible interest includes that incurred by mortgages student loans and investments. Interest paid on personal loans is not tax deductible.

Typically deducting car loan interest is not allowed. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Tax-deductible interest is the interest youve paid for various purposes that can be subtracted from your income to reduce your taxable income.

Other Relevant Points Only Interest paid allowed to be treated as an Expense and not. Experts agree that auto loan interest charges arent inherently deductible. Dont go it alone and assume you are doing things correctly.

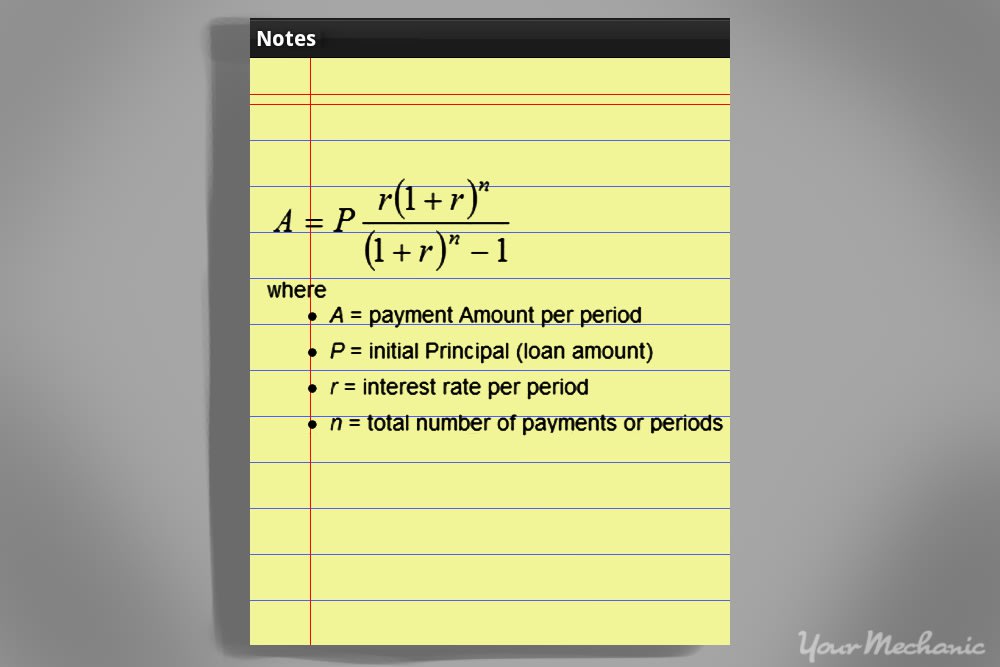

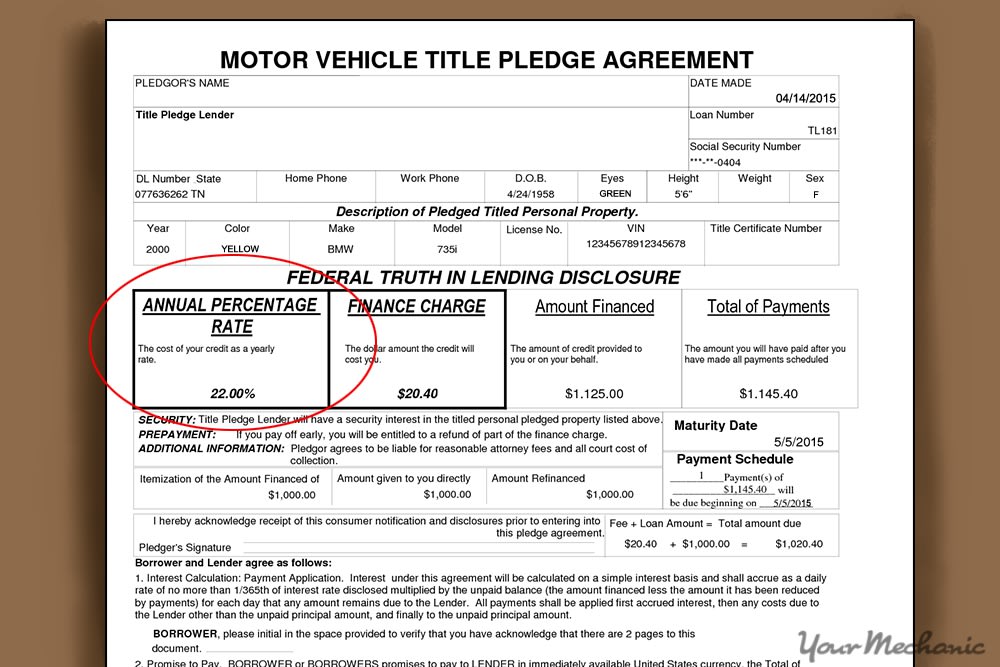

First an amount applies towards the principal and second the interest due. You can only claim deductions for the time you drive for Uber. Since the car that Heather bought is a passenger vehicle there is a limit on the interest she can deduct.

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. When repaying student loans interest is tax deductible provided that you do not file separately while being married. In order to do this your vehicle needs to fit into one of these IRS categories.

You can deduct car loan interest when filing your taxes. The Australian government recently announced tax rebates of up to 150000 on vehicles purchased for business use by small business owners. To the right of the vehicle click Edit.

One of the benefits of rideshare driving is you can deduct car loan interest from your taxes. Click on Edit to the right of the business name. Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer 11.

Unfortunately car loan interest isnt deductible for all taxpayers. The interest you pay on student loans and mortgage loans is tax-deductible. If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized deduction.

Heathers available interest is the lesser of the following amounts. Expanding a business is a big dealcongratulations. At the page Based on the miles you drove choose Ill enter my actual expenses.

2200 the total interest she paid in her 2021 fiscal period. Should you use your car for work and youre an employee you cant write off any of the interest you pay on your auto loan. But you will need to keep accurate.

Car loan interest is tax deductible if its a business vehicle.

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Car Loan Tax Benefits And How To Claim It Icici Bank

Quickstudy Finance Laminated Reference Guide Tax Prep Checklist Tax Prep Small Business Tax

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Is Car Loan Interest Tax Deductible Lantern By Sofi

Is Car Loan Interest Tax Deductible Lantern By Sofi

Solved Where To Enter Car Loan Interest

Quickbooks Self Employed Review 2022 Carefulcents Com Quickbooks Small Business Accounting Online Taxes

Financing A Car What You Need To Know Credit Com

6 Surprising Tax Deductions For Uber And Lyft Drivers

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business